Millions of consumers will be offered free, tailored financial support from banks and pension providers under sweeping new proposals from the City regulator, in a bid to steer people away from risky online advice and poor money decisions.

Category: Money & Tax for the Self-Employed

Everything you need to manage money and tax as a freelancer or sole trader – from self-assessment to invoicing and cashflow.

Sweet or taxable? M&S strawberry sandwich sparks new VAT debate

Marks & Spencer’s new strawberry and cream sandwich has captured attention on social media — but now it’s caught the eye of tax experts, too.

Inheritance‑tax take hits £1.5bn in two months as flight of non‑doms casts doubt on future revenues

Inheritance‑tax receipts reached £1.5 billion in April and May, the first two months of the 2025‑26 tax year, HM Revenue & Customs revealed on Thursday.

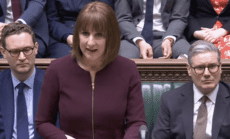

Rachel Reeves reconsiders non-dom tax changes to halt exodus of wealthy individuals

Chancellor Rachel Reeves is considering softening Labour’s flagship plans to scrap the non-domiciled tax regime, amid rising concern over the growing exodus of wealthy individuals and business leaders from the UK.

SME lending delays slashed by 80% thanks to fintech-driven back-office reform

UK fintech innovation is transforming SME finance. Community lender BCRS cuts loan processing times by 80%, showing how digital back-office reform boosts small business access to funding.

HMRC inheritance tax investigations surge 37% as treasury seeks to plug revenue gap

Families face mounting pressure as HMRC inheritance tax investigations rise 37% in a year. Find out what triggers a probe and how to stay compliant.

HMRC launches crypto crackdown with new data-sharing rules for platforms and traders

Millions of UK cryptocurrency holders will soon be required to disclose their personal details to digital asset platforms, as HM Revenue & Customs (HMRC) rolls out a sweeping new crackdown on tax avoidance in the sector.

‘Not pension piggybanks’: experts warn millions of savers at risk under government reform plans

Pension campaigners and financial experts have issued a stark warning to ministers over proposed changes that could allow employers to extract surplus cash from retirement schemes — and grant government powers to direct pension fund investment into UK assets.

Pensions at risk as HMRC eyes salary sacrifice schemes in Autumn Budget

Pensions tax relief may be in the firing line in the upcoming Autumn Budget, with growing concern among financial experts that HMRC is targeting popular salary sacrifice schemes as a way to raise revenue.

Trump’s proposed tax changes could sharply raise costs for globally mobile US employees and businesses

Planned US income tax reforms under Trump’s ‘One, Big, Beautiful Bill’ could make global mobility far more expensive by 2026, warns Blick Rothenberg.

London launches first regulated crypto derivatives platform as digital assets enter mainstream

GFO-X becomes the UK’s first FCA-regulated crypto derivatives trading platform, marking a key milestone in institutional adoption of digital assets in London.

Employers show strong interest in ‘Dutch-style’ CDC pension schemes promising higher retirement payouts

More than 200 UK employers are exploring collective defined contribution (CDC) pension schemes, which could boost retirement income by up to 50% for the same cost and risk.

Inheritance tax hits record £8.2bn as frozen thresholds drag more families into net

HMRC inheritance tax receipts hit a record £8.2bn in 2024-25, driven by frozen allowances and rising asset values. Further changes to pensions and farmland relief set to increase future liabilities.

Companies House collects just £1,250 in fines despite new powers to tackle fraud

Companies House has collected just £1,250 in fines under new anti-corruption powers, raising concerns over the UK’s ability to tackle fraud, money-laundering and sanctions evasion effectively.

HMRC considers overhaul of £8bn R&D tax credit scheme amid fraud concerns

The UK government is reviewing its £8bn R&D tax credit scheme, proposing mandatory pre-approval to curb fraud and improve access, following £4.1bn in losses to error and abuse.