The annual self-assessment deadline is once again taking a heavy emotional and financial toll on Britain’s self-employed workforce, with new research suggesting that tax stress is now making many question whether working for themselves is worth it at all.

Research from Taxfix, Europe’s AI-powered tax accounting platform, found that almost one in five self-employed people would rather pay a £100 fine than face the stress of filing their tax return on time. With the 31 January deadline approaching, 25 per cent of respondents admitted they plan to leave filing even later than usual this year.

The findings come as HMRC revealed that, as of 2 January, 5.65 million people – around 47 per cent of those required to complete a self-assessment – had yet to submit their return. Rather than apathy, Taxfix’s data points to complexity and anxiety as the main drivers of delay.

Among those still to file, complex forms, frequently changing tax rules and the stress associated with getting something wrong were cited as the biggest barriers to starting. More than half of respondents said poor customer service and a confusing HMRC website actively put them off beginning the process.

For many, the burden of self-assessment is starting to overshadow the benefits of self-employment. A third of self-assessors said filing a tax return is the worst part of working for themselves, while one in six admitted the process makes them reconsider being self-employed altogether.

London-based freelance producer Connor Gani said the system feels stacked against sole traders. “Every year, I’m forced to navigate the same system a limited company uses, scrolling through endless pages that don’t apply to me, with constant warnings about penalties,” he said. “You’re always worried you’ve underpaid, but you rarely know if you’ve overpaid either. With little clarity on what you can expense, it’s almost impossible to feel confident you’ve got it right.”

He added that the timing of the deadline compounds the problem. “November to February is often quieter for freelancers. Spending hours on tax instead of finding work feels brutal – and it’s a big reason I’m considering going back into full-time employment.”

The stress is spilling over into personal lives too. Nearly 40 per cent of respondents said they felt anxious over the Christmas period or failed to feel rested because they spent the break worrying about their tax return. One in ten said the process derailed their New Year’s resolutions, while around 600,000 people said tax stress ruined their Christmas altogether.

Asked why they delay filing, respondents pointed to the pressure of the process itself, competing work demands, the need to prioritise income generation, and the cost of hiring an accountant. More than a quarter said they would rather clean the fridge than tackle their tax return.

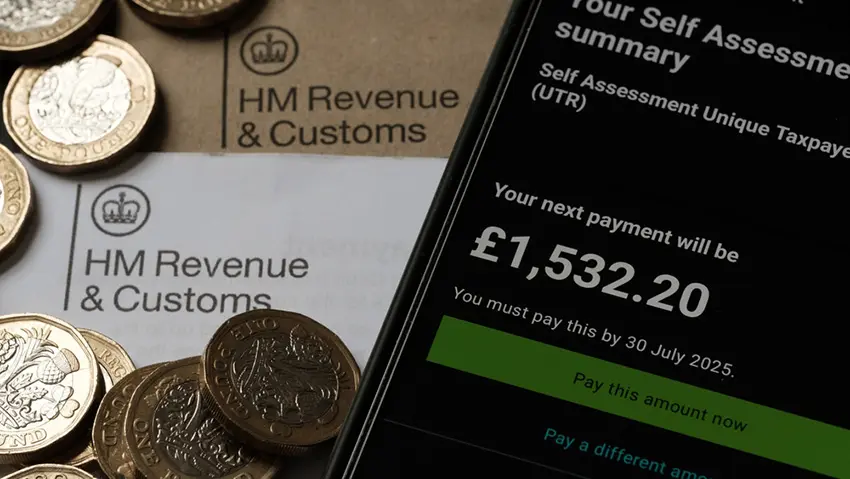

The cost of delay is significant. Last year, HMRC issued more than £110 million in late-filing penalties after over one million people missed the deadline. Anyone who files late automatically receives a £100 fine, with additional daily penalties applying after three months.

Martin Ott, chief executive of Taxfix, said the system is no longer fit for purpose. “With the longest tax code in the world and constantly changing rules – including the rollout of Making Tax Digital – self-assessment is not getting any easier,” he said. “Tax filing should be as simple as ordering a pizza. No one should be paying unnecessary fines because of an outdated, overly complex process.”

Looking ahead, most self-assessors said their relationship with tax would improve significantly if the system were simplified. Many want clearer rules on deductions, less complexity in tax law and mobile-friendly filing that fits around modern working lives.